Don’t make money decision based on my ramblings, but somehow I’ve found myself in and around quite a few investment conversations lately so I wanted to share a couple things that have helped me.

- When I found Dave Ramsey’s “7 Baby Steps“, it solidified a lot of ideas and thoughts I had around saving for emergencies, getting out of debt, and saving for retirement. He has plenty of books, website material, and podcast episodes about it, but honestly, the list alone is a great guide for us because I didn’t need to be convinced that it made sense.

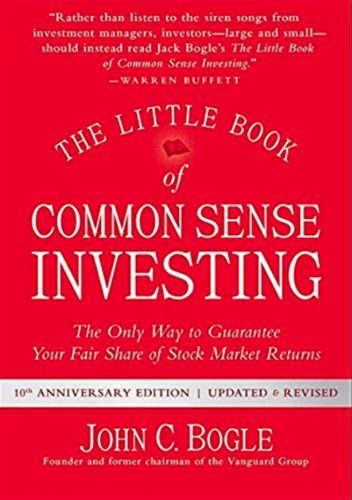

- If I only read one book about investing (and that’s not too far off), I would want it to be “The Little Book of Common Sense Investing” by John Bogle. It’s short and it’s simple. He repeatedly lays out statistics to show that buying individual stocks is a gambling hobby. Investing for the long term means buying and holding a total stock market index fund (or ETF) and maybe a total bond fund and a total international fund too. Yes, there will be flashes of success here and there where people beat the market in the short term, but the lasting, winning bet is a low cost index fund that covers the whole market. It’s nearly unbeatable, and it’s super easy.

Ask me in thirty or forty years how it worked out.