I think about retirement more than is normal for someone of my age, but saving for retirement is a long-term game. My basic plan has been to save some money, pay off debt, and then save more money. We’ll see how well that works out for me, but it aligns well with Dave Ramsey’s “7 Baby Steps“.

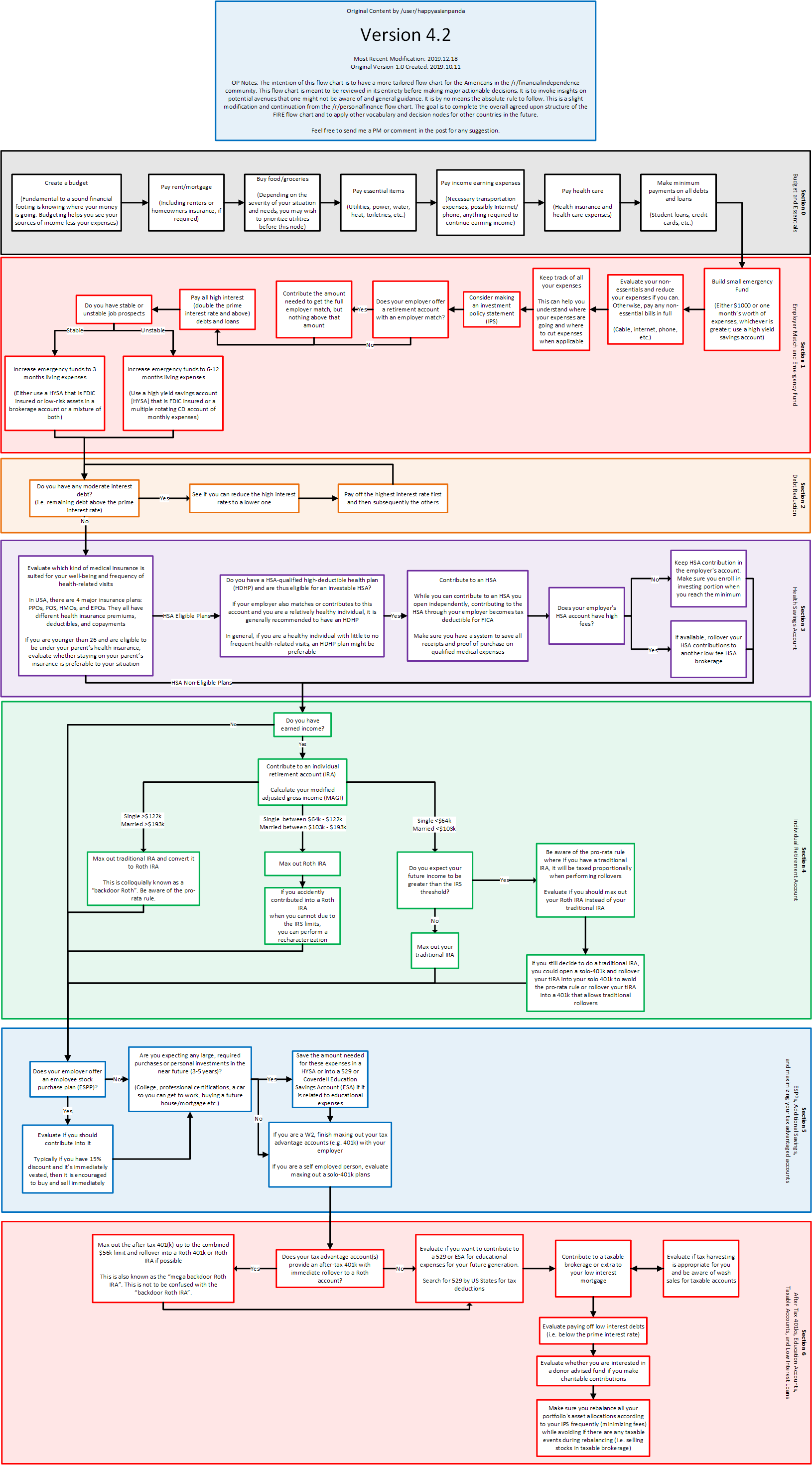

Those basic guidelines are great, but there are so many small choices along the way. What’s a good order to do them in? Then I found a flow chart on reddit and I was in awe! I’m sure there are people with different opinions, but if I have a tough time believing that anyone would go too far off course if they followed this verbatim. You should be able to click into it to see all the details, but if not, check out the linked post above for the original content.